Forum Post: michell bachmann is right - we need to repeal the ACA

Posted 12 years ago on March 23, 2013, 7:58 a.m. EST by bensdad

(8977)

This content is user submitted and not an official statement

just to screw with rick scott & jan brewer

any comments on Charlie Crist ?

http://angryblackladychronicles.com/2013/03/21/leave-it-to-rapist/

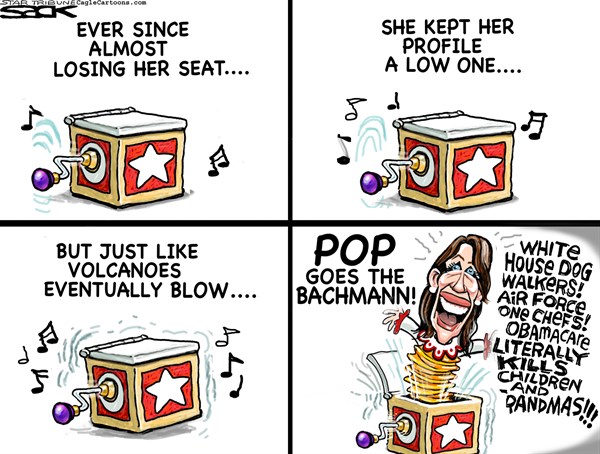

Is there anything not crazy about Bachmann?

Of course the real issue is not michelle, it it all of the lemmings who vote for her

Their Pastors and the brothers Koch, told them too.

ACA should be repealed. The only decent thing about it is the previous conditions clause, and even that doesnt put a specific percentage that it must stay to the average for whatever demographics may apply.

Forced corporatism. They just forced you buy from the one of the top five corporate lobbies that are destroying the country.

And you are gobbling up every bit of it.

Similar to Bush's "Ownership Society" where all the sheep thought it was great but it was really just a cover for crashing housing.

Similar to Clinton and his "SErvice Economy" which was really just cover for corporations shipping all their jobs to zero env reg and labor reg countries.

And you just keep gobbling it up like a good little follower.

We dont need anymore followers.

ACA is a joke. Wr need a limited single payer nationwide healthcare plan paid for by a 10% VAT. This plan should cover well baby care, pregnancy, ER visits, basic, basic health care.

No surgeries, limited medicines, no joint replacement, limited cancer treatment, rapid end of life decisions.

A single payer system can't pay for expensive end of life care because EVERYONE eventually needs it. Insurance works because 1000s of people drive, but only scores get in accidents. In medical care everyone needs to pay individually for their own final "accident."

Your plan sucks. There is no reason not to have a national fully inclusive health care plan with an emphasis on lifestyle education and preventative care. The problem with medicine is it is a for profit business. That runs contrary to the very principals of the hippocratic oath. Nationalize the universities and the healthcare system they should have never been private to begin with.

Reality sucks. Learn to live with it. No where in the oath is profit reviled. No one is gonna spend 14 years to get educated for a $75000 yearly income.

People need to provide for themselves if they want high end care. Lifestyle education and preventative care are pablum words to make YOU feel like you are offering wisdom. You aren't. Is there a single soul who doesn't know lack of exercise and over indulgence damages health?

There are consequences to bad decisions. Accept that.

You are wrong not everyone does things for the economic incentive. I am getting the feeling you are a obstructionist.

I agree that Medicare for all is best - tax all corps an excess profits tax

But until we get a majority of pro-99% reps in congress & eliminate corporate personhood, pro-99% solutions will not pass

dont tell the new recipients of Medicaid that ACA is all bad

dont tell the parents of a 22 year old that ACA is all bad

dont tell someone with a pre existing condition that ACA is all bad

I can never figure out if the anti-ACA people just refuse any non-perfect solution or if they are trolls

[Removed]

Medicare for all doesn't work either. Medicare covers way too much. It's un affordable. What's an excess profits tax? That's isn't feasible. It has to be a regressive tax, a VAT, that taxes everyone at an equal rate. What's Medicare cost now? It's budget is $600 billion for 48 million enrollees. That's about $13000/year/retiree. Exxon's profit last year was $18 billion. That's a drop in the bucket for medical care.

VAT is far too complicated - and too different from what we have - and is very regressive.

The person who MUST buy a gallon of milk would HAVE to pay the VAT

The person who decides to buy a plane, can decide not to if the VAT makes it too expensive.

FROM WIKI:

In the United States, an excess profits tax is a tax, some say excise tax, on any profit above a certain amount. A predominantly wartime fiscal instrument, the tax was designed primarily to capture wartime profits that exceeded normal peacetime profits.[citation needed] [edit] History

In 1863 the Confederate congress and the state of Georgia experimented with excess profits taxes, perhaps, the first time it has happened in American history. The first effective national excess profits tax was enacted in 1917, with rates graduated from 20 to 60 percent on the profits of all businesses in excess of prewar earnings but not less than 7 percent or more than 9 percent of invested capital. In 1918 a national law limited the tax to corporations and increased the rates. Concurrent with this 1918 tax, the federal government imposed, for the year 1918 only, an alternative tax, ranging up to 80 percent, with the taxpayer paying whichever was higher. In 1921 the excess profits tax was repealed despite powerful attempts to make it permanent. In 1933 and 1935 Congress enacted two mild excess profits taxes as supplements to a capital stock tax.

The crisis of World War II led Congress to pass four excess profits statutes between 1940 and 1943. The 1940 rates ranged from 25 to 50 percent and the 1941 ones from 35 to 60 percent. In 1942 a flat rate of 90 percent was adopted, with a postwar refund of 10 percent; in 1943 the rate was increased to 95 percent, with a 10 percent refund. Congress gave corporations two alternative excess profits tax credit choices: either 95 percent of average earnings for 1936–1939 or an invested capital credit, initially 8 percent of capital but later graduated from 5 to 8 percent. In 1945 Congress repealed the tax, effective 1 January 1946. The Korean War induced Congress to reimpose an excess profits tax, effective from 1 July 1950 to 31 December 1953. The tax rate was 30 percent of excess profits with the top corporate tax rate rising from 45% to 47%, a 70 percent ceiling for the combined corporation and excess profits taxes.

In 1991 some members of Congress sought unsuccessfully to pass an excess profits tax of 40 percent upon the larger oil companies as part of energy policy.

[Removed]

A:You bet it is. The Government Accountability Office estimates the 75-year funding gap will be a staggering $76.4 trillion. The Medicare Security Trust Fund could run dry as soon as 2016, according to a 2011 report from the trustees. And the system is rife with fraud and abuse, costing us nearly $100 billion a year—yes, a year—according to some congressional estimates.

To make matters worse, the government can't seem to get its long-term projections in line. Just last month, the Congressional Budget Office slashed its 10-year budget projection by $143 billion, or 2.2%. It noted that spending was "significantly lower" than projected the last three years, thanks mostly to technology and somewhat to legislation. Is that a trend or a recession-related blip?

By some estimates, we will receive health care that costs three times what we paid into it in our lifetimes. Clearly, that's unsustainable and the only way out is to cut benefits or up the individual ante—neither of which garners much enthusiasm from, well, anyone.

But, like Social Security, some form of Medicare will be around for some time though you can expect that it will be parceled and pared down considerably.

$76 trillion!! Cost overrun. Given the entire value of everystock in the S&P 500 isn't anywhere close to $76 trillion, can you honestly say Medicare for all is what we want?

-2 for speaking facts. Wow. No wonder Congress is ineffective.