Forum Post: Is The Baker-Clinton-Iran Road Show A Diversion For The Banks Or A War Warning For Us?

Posted 13 years ago on June 21, 2012, 6:53 p.m. EST by vvv0621

(-1)

This content is user submitted and not an official statement

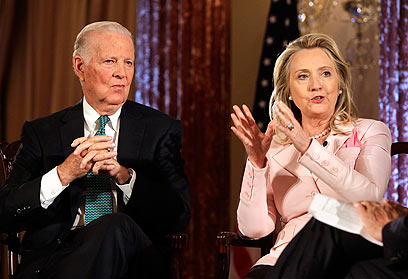

Is The Baker-Clinton-Iran Road Show A Diversion For The Banks Or A War Warning For Us?

The global elite have a bipartisan go-to team from Hell -- Hillary Clinton (Democrat) and James Baker (Republican) -- being interviewed together by every major media talking head except Big Bird this week brainwashing the Sheeple in preparation for a preemptive attack on Iran. If this was not timed to be a distraction from the bank credit rating downgrades by Moody's...

...then perhaps we should view this propaganda tour as a war warning and prepare accordingly. For more go to Google News and search this:

baker clinton iran

I saw them on Charlie Rose last night and Hillary made an interesting comment that should resonate with Occupiers.

She said she was in Egypt during the initial protests and asked some protesters about the govt they wanted. They told her they weren't into politics. Her point was the military has filled the vacuum that the protesters weren't interested in filling. Food for thought

That's why fleabaggers are losers and are not supported by the 99%

no the bloody Iran scare

is a diversion from the the countries we are already attacking

worse still

US will go to war with ran if they think the are allowed

First they divert your attention elsewhere, then they sucker punch you.

Both.

Good post vvv.

General Wesley Clark Reveals 5 Year USA War Agenda From 2007 - 2012

http://www.youtube.com/watch?v=_1SP8C9jNE4

Moody's downgrades firms with global capital markets operations:

Actions conclude review initiated on 15 February 2012

New York, June 21, 2012 -- Moody's Investors Service today repositioned the ratings of 15 banks and securities firms with global capital markets operations. The long-term senior debt ratings of 4 of these firms were downgraded by 1 notch, the ratings of 10 firms were downgraded by 2 notches and 1 firm was downgraded by 3 notches. In addition, for four firms, the short-term ratings of their operating companies were downgraded to Prime-2. All four of those firms also now have holding company short-term ratings at Prime-2. The holding company short-term ratings of another two firms were downgraded to Prime-2 as well.

"All of the banks affected by today's actions have significant exposure to the volatility and risk of outsized losses inherent to capital markets activities", says Moody's Global Banking Managing Director Greg Bauer. "However, they also engage in other, often market leading business activities that are central to Moody's assessment of their credit profiles. These activities can provide important 'shock absorbers' that mitigate the potential volatility of capital markets operations, but they also present unique risks and challenges." The specific credit drivers for each affected firm are summarized below.

Today's rating actions conclude the review initiated on 15 February 2012 when Moody's announced a ratings review prompted by its reassessment of the volatility and risks that creditors of firms with global capital markets operations face. In the past, these risks have led many institutions to fail or to require outside support, including several firms affected by today's rating actions. Today's actions, however, reflect not only the credit implications of capital markets operations. They also reflect (i) the size and stability of earnings from non-capital markets activities of each firm, (ii) capitalization, (iii) liquidity buffers, and (iv) other considerations, including, as applicable, exposure to the operating environment in Europe, any record of risk management problems, and risks from exposure to US residential mortgages, commercial real estate or legacy portfolios.

OVERVIEW OF TODAY'S RATING ACTIONS:

http://www.moodys.com/research/Moodys-downgrades-firms-with-global-capital-markets-operations--PR_248989

What in the world does this have to do with your original post? A thinly disguised bump? That's what this post is!